Hi everyone, today we’d like to recommend a great 30 min talk Axel Leijonhufvud gave at INET’s 2012 “Paradigm Lost” Conference in Berlin (thanks to Charlotte Bruun for reminding us of his work!).

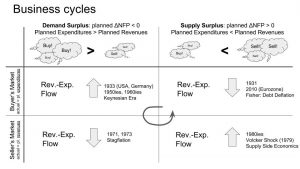

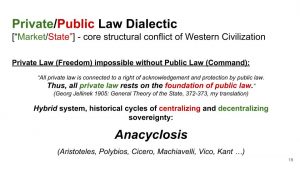

The way he describes the 2 forms of instability the web of contracts at the heart of western civilization (which is based upon the private/public law – dialectic): deflation and inflation, and the dilemmas politicians face when trying to intervene, connects to Katharina Pistor’s Law-Finance-Paradox and comes close to a rudimentary theory of some of the economic roots of anacyclosis. The international monetary system, being based on non-enforceable “soft law” treaties in international public law, is even more fragile and subject to both instabilities Leijonhufvud describes. The gold standard cracked during the deflationary instability of the 1930s. The Bretton Woods system cracked during the inflationary instability of the late 1960s and 1970s.

From the perspective of long cycles, we like to visualize and conceptualize the alternating pattern of deflation and inflation like this:

What is anacylosis?

It is a pattern of history well known in the history of republican thinkers (from Plato and Aristotle to Polybios, Cicero and Machiavelli): the cycle of more centralized, authoritarian and more decentralized, democratic forms of government in western civilization, of which we are witnessing another round right before our eyes during the democratic recession which started in 2005 and is in full swing world wide now (2018). From our perspective, it is directly rooted in one of the fundamental conflicts of western civilization: the conflict between the principles of private and public law (free contract/consent vs. authoritative legislation/command), and the inherent instability of an unregulated private law (property and contract) based, monetary “free market” economy.

Katharina Pistor has voiced similar intuitions more from the perspective of a lawyer in her short (9 p.) 2013 paper, “The State, the Market and the Rule of Law” (and in her “Legal Theory of Finance” paper). Neither Axel nor Katharina, however, draw a connection to the historical pattern and the theory of anacyclosis, because they take a systematic perspective only, not doing large scale and long term historically comparative analysis.

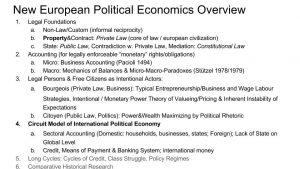

From our perspective, the legal, economic and comparative historical perspectives must be integrated to achieve a realistic understanding of western civilization, its historical patterns and its present state & situation in Europe – that is the core of the research program we are developing:

Thinkers like Axel Leijonhufvud, Katharina Pistor, and Polybios are all important contributors to this integrative and clarifying work, culminating in Level 5 of our analysis (see above): Long Cycles – discovering larger scale historical patterns of western civilization that repeat with variations.

If you like what we do and it makes sense to you, you probably will enjoy their contributions to better understanding the anacyclosis pattern and the democratic recession we are experiencing now in the aftermath of the 2008 crisis:

Axel Leijonhufvud: Debt, Inflation and Austerity (video, 30min talk)

Katharina Pistor: The State, the Market and the Rule of Law (9 p.)

The Institute for Anacyclosis: The Crisis (2 p.)

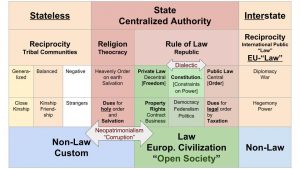

ANEP Economics: Overview of New European Political Economics – our own approach to Integrate Law, Business and Macroeconomics by way of making explicit the Law-Accounting-Connection and comparing this to the stateless “Non-Law”: of traditional stateless hunter-gatherer and segmentary communities and the international community of states (international “law” which, to use E.A. Hoebel’s bonmot, is “primitive law on the global level”).